About PetroVal

PetroVal specializes in the appraisal of retail petroleum facilities on a national basis. We provide superior quality appraisals of convenience stores, service stations, travel plazas/QSR’s, and truck stops for financial institutions and companies. PetroVal delivers well-documented appraisal reports on a timely basis, a key to your success and ours.

Mission Statement

PetroVal provides specialized professional appraisal services for convenience and gas properties to help protect the health, safety, and soundness of the banking system.

Founding

PetroVal was founded in 2000 by two appraisal industry veterans with abundant field appraisal and bank review appraisal experience. The intent from the beginning was to serve the lending industry with a laser focused appraisal firm devoted to an often-misunderstood property type, convenience and gas.

The late 1990’s had seen a surge of Convenience and Gas (C&G) loans made through Wall Street Banks in the CMBS markets. Due in part to poor quality appraisals that over-leveraged the C&G assets, as well as high prepayment penalties in a declining interest rate environment, the market began to unravel in 2000. It experienced some of the largest defaults rates ever witnessed on the underlying bonds. (It was something of a harbinger of the 2008 sub-prime debacle that unfortunately no one paid attention to.) A CMBS borrower that PetroVal interviewed indicated that the oil company’s retail assets were more than 100% leveraged with a high interest long term loan. They simply stopped making their payments and were prepared to hand over the keys and walk away satisfied they had sold their assets to the unfortunate bondholders, who had hoped for a long-term income stream.

Later in 2000, Bank United of Texas began to experience large loan losses on C&G properties. To bolster its battered stock price Bank United, the largest Texas based bank at that time, had to put itself up for sale and was acquired by WAMU in late 2000. So, it was in this environment that Joe Anderson and Mark Appling created PetroVal on a foundation of ethical practice and technical expertise.

The ensuing years saw rapid growth of the practice as demand for the specialized appraisal services grew.

Today

In this uncertain economic environment, it is more important than ever to use a professional team who focus on all facets of this property type. We keep an eye on all of the variables and stay up to date on all changes and trends in this industry. PetroVal has a team of professional appraisers ready to handle your C&G assignments, whether a single unit or a portfolio of stores across a large region. Give our office a call to discuss your C&G appraisal needs today.

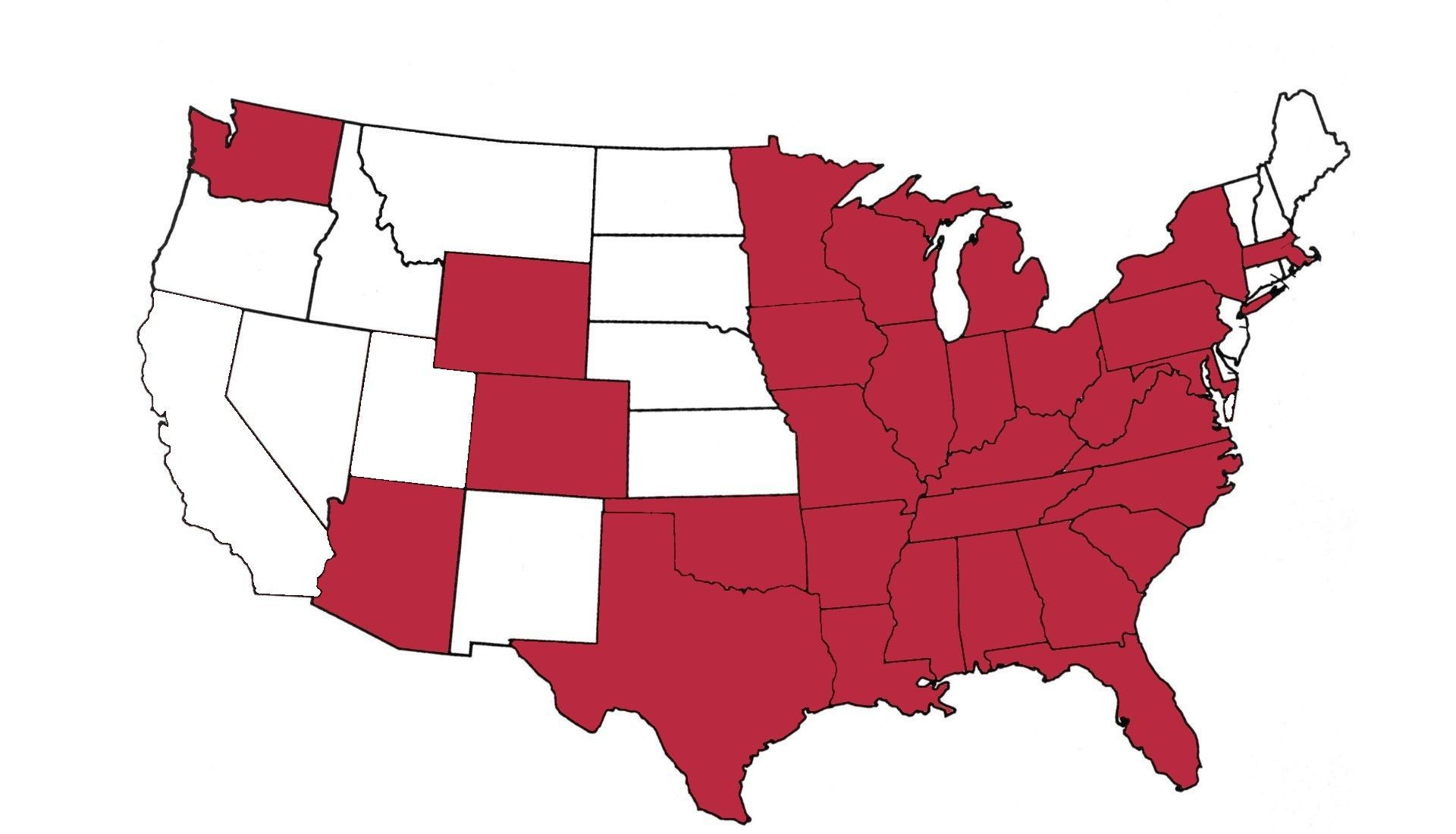

State Certifications

Joe Anderson is Certified in 30 states